Contents

We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. We provide content for over 100,000+ active followers and over 2,500+ members. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. A little-known technique is the double Bollinger bands trading strategy. With this trading method, day traders can pinpoint entry and exits with ease.

- Since we are talking about trend trading, it makes sense to use the trailing stop and wait for the signal of the trend end.

- In addition, the formation is easy to read visually, as well as in terms of its interaction with Bollinger Bands and the impact on trading volumes.

- Then, at regular intervals, the stop loss is pulled up by the price movement distance.

- More times than not, you will be the one left on cleanup after everyone else has had their fun.

Although Bollinger Bands can alert you to potential breakout trades, it doesn’t tell you the direction of the breakout. The markets move from a period of high volatility to low volatility . If you want to have a higher probability of success with the Bollinger Band strategy, then you’ll need a few confluence factors coming together before you trade the bands. If you want to make money in the markets, just buy low and sell high. The price is above the 20 period MA but RSI is showing the market is overbought. An easy-to-use software platform that allows you to scan market data, identifying historical trends and market cycles that match your search criteria.

All Moving Averages (SMA, EMA, SMMA, and LWMA)

In fact, there are a number of uses for Bollinger Bands®, such as determining overbought and oversold levels, as a trend following tool, and for monitoring for breakouts. John Bollinger used the M patterns with Bollinger Bands to identify M-Tops. In its basic form, an M-Top is similar to a Double Top chart pattern.

Often, shapes precede a reversal or are themselves part of a trend reversal. I will tell you about the two most common shapes – W and M. In addition to the classic setting of Bollinger Bands, combined options are possible as well.

We provide a risk-free environment to practice trading with real market data over the last 3 years. It’s one thing to know how the E-mini contract will respond to the lower band in a five-day trading range. That doesn’t mean they can’t work for you, but my trading style requires me to use a clean chart. It’s safe to say Bollinger Bands is probably one of the most popular technical indicators in any trading platform.

Thanks to his invention, bands became much more useful in the art of forecasting future prices through technical analysis. To add Bollinger bands to your trading chart, look for the option to add indicators. Bollinger bands should be offered alongside other tools like RSI, average volume, and more. Bollinger bands aren’t a perfect indicator; they are a tool. They don’t produce reliable information all the time, and it’s up to the trader to apply band settings that work most of the time for the asset being traded. If the price is in a downtrend and continually hitting the lower band , when the price hits the upper band it could signal that a reversal has commenced.

Why is it so important to measure market volatility

Timothy Li is a consultant, accountant, and finance manager with an MBA from USC and over 15 years of corporate finance experience. Timothy has helped provide CEOs and CFOs with deep-dive analytics, providing beautiful stories behind the numbers, graphs, and financial models. The price then pulls back towards the middle band or higher and creates a new price low that holds the lower band. When the price moves above the high of the first pullback, the W-button is in place as shown in the figure below, and indicates that the price will likely rise to a new high.

Therefore, these averages are not recommended for Bollinger trading. Let’s compare the indications of moving averages using an example. We will receive the main signals from Bollinger Bands. We will use them to identify opportunities https://1investing.in/ for opening and closing positions. This is a formation in which retesting occurs at a higher level. This is true only when analyzing the absolute location of the lows, i.e. the location relative to the coordinates of the chart.

Settle on a market you want to master (i.e., futures, equities, forex). If you try to learn all three at the same time, you are going down a painful road. These are but a few of the great methods for trading with bands.

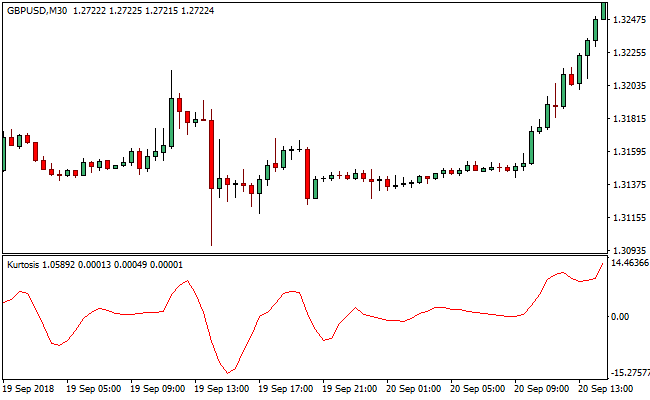

As John Bollinger argued, periods of low market activity are cyclically replaced by periods of high volatility. This statement is the essence of the Bollinger Squeeze strategy. By clicking on the OK button, you launch the indicator with default settings. In the ripple future predictions area of the chart marked with a blue oval, the candlestick crosses the lower band. Here line K crosses D, and the Stochastic itself shows oversold below the 20% level. It is recommended to use the strategy of double Bollinger bands on trend instruments.

During a Bearish market traders look to go short when the price hits the upper band. With established guidelines on how to use the Bollinger bands, find settings for the indicator that allow you to apply the guidelines to a particular asset you are day trading. Alter the settings so that when you look at historical charts, you can see how the Bollinger bands would have helped you. Bollinger bands help assess how strongly an asset is rising , and when the asset is potentially losing strength or reversing. This information can then be used to help make trading decisions. Here are three guidelines for using Bollinger bands in an uptrend.

Bollinger Bands Trading Strategies

I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe. The BandWidth indicator is recommended to be used together with Bollinger Bands. It helps identify the “calm before the storm” and signs of trend changes.

Its most popular use is to identify “The Squeeze”, but is also useful in identifying trend changes… Indicators can be normalized with %b, eliminating fixed thresholds in the process. To do this plot 50-period or longer Bollinger Bands on an indicator and then calculate %b of the indicator. %b has many uses; among the more important are identification of divergences, pattern recognition and the coding of trading systems using Bollinger Bands. This scan finds stocks that have just moved below their lower Bollinger Band line. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

The Welford method is an algorithm for calculating the running average and variance of a series of numbers in a single pass, without the need to store all the previous values. It works by maintaining an ongoing running average and variance, updating them with each new value in the series. The running average is updated using a simple formula that adds the new… The Oscillator Extremes indicator plots the normalized positioning of the selected oscillator versus the Bollinger Bands’ upper and lower boundaries. Currently, this indicator has four different oscillators to choose from; RSI, CMO, CCI, and ROC. When the oscillator pushes towards one extreme, it will bring the value of the prevailing line closer to zero.

How to Calculate Bollinger Bands?

You need to test and analyze the chart of an asset and go back to see if you have chosen the right deviation. Select the number of moving average periods as you are comfortable. If you are a long-term investor, you may need to select a higher number, and as a short-term trader, you may need a smaller number. Bollinger Bands is placed on the price chart, containing three lines. The middle line is a moving average , and the two others located above and under the moving average are bands.

But some traders also use three type of bands such as lower band, upper band and the middle band. The price values depends on the movements of the bands. The Bollinger Bands indicator was invented by the renowned trader and financial analyst John Bollinger in the early 1980s. They essentially help you identify possible price reversals by determining overbought and oversold levels using standard deviation.

When analyzing a figure, I also recommend paying attention to volume. On the left side of the figure, especially in the head area, it is characterized by high values. At this point, news is published preceded by rumors and expectations. After passing the peak of the head, activity decreases. A small surge of optimism can be observed on the right shoulder or the last jump up. Equality of the lows on the left and right sides indicates a calm market.

We use a higher number of periods on the CCI in order to smooth the indicator. As you can see, this setup generated 4 valid short positions. When the price reaches this area, we look at the Stochastic Oscillator to enter the market. Ideally, we want the Stochastic to be in an overbought area. If not, a divergence on the Stochastic would be also a great confirmation.